Retirement survey: don’t leave it too late to save

Everyone has a different idea of what their retirement will look like

From travel and adventure to relaxing at home with the family, there’s a myriad of options to consider.

One thing’s for sure, you’ll need adequate finances to sustain each and every one.

Nevertheless, it’s clear that many of us aren’t sufficiently planning ahead.

We commissioned a Retirement Survey in March 2022, with a sample size of 1,009 respondents across the UAE. The results were surprising.

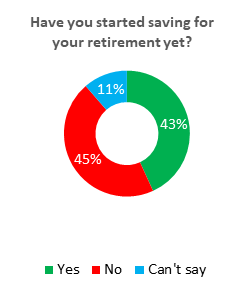

According to the survey, while 63% planned to retire before they reached the age of 60, 45% said they hadn’t yet started saving for that retirement.

| At what age do you expect to retire (or did retire)? | |

|---|---|

| Under 45 | 13% |

| 45 to 50 | 16% |

| 50 to 55 | 15% |

| 55 to 60 | 19% |

| 60 to 65 | 18% |

| Over 65 | 10% |

| Don’t know/not sure | 9% |

The current average life expectancy in the UK, UAE and India is 81.77, 78.46 and 70.42 respectively, and this is expected to increase over the next 20 years. Obviously, there’s a problem here.

So, when do people plan to start saving?

It’s clear from the responses to the survey that they’re going to leave it late. 16% said they’d leave it until 5 years before they retire, 22% saying between 5 and 10 years before and 18% between 10 and 15 years. Just 25% will plan more than 15 years ahead and 19% say they don’t know when they’ll start at all.

57% of married people with children said they would leave it 15 years or less before retirement to start saving.

Of course, how much you need to save for your retirement will depend on the type of retirement you’re envisaging.

More than half of those surveyed said they’d need USD 5,000 or less per month to live on during retirement. That includes 61% of those in the 45 plus age bracket and 60% of those in the married with children segment.

How much income do you think you will need when you retire? – by age group

| 18-24 | 25-34 | 35-44 | 45+ | Overall | |

|---|---|---|---|---|---|

| Between US$0 and US$2,500 per month | 12% | 26% | 30% | 31% | 27% |

| Between US$2,501 and US$5,000 per month | 22% | 25% | 26% | 30% | 26% |

| Between US$5,001 and US$7,500 per month | 23% | 18% | 12% | 13% | 15% |

| Between US$7,501 and US$10,000 per month | 12% | 7% | 8% | 6% | 8% |

| Over US$10,000 per month | 13% | 10% | 7 | 5% | 8% |

| Don't know/not sure | 18% | 14% | 17 | 15% | 15% |

Looking at these figures, it appears those in the younger age bracket plan to save more per month. Perhaps they are recognising they’ll need more for their retirement? If so, this is an encouraging trend.

More generally, however, it would seem respondents are perhaps counting on an existing pot of money to support them, at least partly, during their retirement.

| What type of savings do you have in place? | |

|---|---|

| General savings/bank deposits | 53% |

| Personal pension plan | 37% |

| Regular savings plan | 36% |

| Individual investment portfolio | 35% |

| Company pension plan | 20% |

| Property/real estate | 1% |

Regular Savings Plan

As more than half said their money is sitting in a bank, it is worth pointing out that money in such an account will lose value over time due to inflation. Better, then, that you ensure you invest your lump sum in a wide range of investments so it continues to grow at a rate that beats inflation.

Without a lump sum to invest, you could pay regularly into a savings plan like RL360’s RSP. This offers access to a range of investment funds which you can use to build a balanced and diversified portfolio. But how much do you need to put into a savings plan each month to achieve your retirement aims?

That obviously depends on when you want to retire and how much money you think you’ll need to cover the kind of retirement you want.

The following example assumes retirement at 60 with a pension pot of $1 million.

| Current age | Required monthly savings in $ |

|---|---|

| 30 | 1,080 |

| 35 | 1,543 |

| 40 | 2,268 |

| 45 | 3,572 |

| 50 | 6,354 |

Source: RL360 – assumes fund growth of 7.5% inclusive of all product charges

As you can see, the best course of action you can take is to tackle the issue head on and start saving early. Because the earlier you start the more time you have for your investments to grow. Don’t leave it too late!