Attitude to Risk

"Attitude to risk", "risk appetite" or "risk reward profile" are terms used to describe an investors level of risk they are willing to take when choosing investments to reach their savings goal. A financial adviser will usually discuss this with the investor at their first meeting so that they can recommend the right investments to suit their needs.

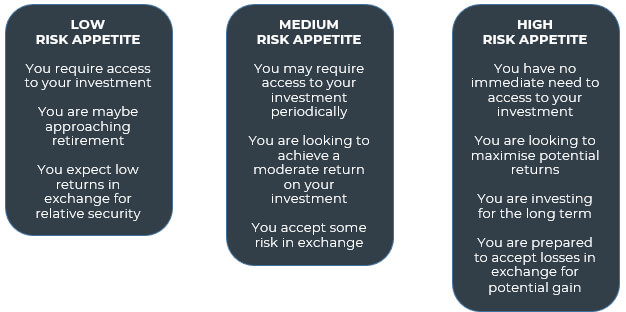

Each investor will have their own tolerance to risk. Some investors are prepared to take a high level of risk for greater growth potential, but equally there are those who are worried about losing money so would rather invest in lower risk assets. The majority of investors will be somewhere in between, understanding that in order to gain growth on their investment they will have to take some level of risk with their investment choices.

Understanding what the savings goal is, and how long the investor can afford to save for, are important factors too. For example, if an investor is young and saving for retirement then they may need to consider taking a higher level of risk with their investment choices in the early years so that they gain value in their pension pot. They can then consider switching into lower risk assets or cash as they reach retirement so that they protect the growth they’ve achieved.

It's important to be aware that even though more risky funds, such as equity funds or hedge funds, have greater growth potential, they also have greater potential for higher losses then a bond fund or cash fund. So, if selecting high risk funds the investor will have to be prepared to make a loss in turbulent times when markets dip, and equally when there is a market rally, they could make a good gain. For low risk assets, they may only receive a moderate return when markets are buoyant and there may be times, such as when there is a market recession, that their investments gain very little growth or even make small losses. The benefit though is that the losses should be considerably less than an equity fund.

Of course, investors don’t have to invest in all high risk or all low risk funds and helping them build a diversified portfolio with a mix of low, medium and high risk funds might be a good solution. The idea is that working together, the funds should provide a smoothed, positive return over the long term. This can be done by selecting different funds from different sectors, or they could simply choose a managed or multi-asset fund which invests across different asset classes, combining high and low risk assets within its own portfolio.